Knowledge of art and risk reduction in investing

Like all investing opportunities, art collecting will produce increasing financial return, if you systematically expand your knowledge. Here are some helpful steps to keep in mind.

The first rule in acquiring a work of art is to buy what you like. This is important, but it must be kept in mind that what you like will depend on knowledge and familiarity with a wide range of works of art. For example, if you are not fond of abstract works, this might be due to your lack of understanding of how to take in what might at first seem confusing. Your taste may change if you read about abstract art, go to lectures at a local gallery on the works of abstract artists or talk with a commercial art dealer. One thing to remember is that your tastes can and will change as you become more familiar with the world of fine art.

Acquiring knowledge about art is a two-fold process. The first step is to look, look and look some more. There is no substitute for studying art firsthand. As you visually take in more and more, you will begin to refine your skills at picking out aspects that make a picture, print, photograph or sculpture work. Inspect a series of pieces by a single artist and determine the details that indicate that they are all by the same artist. You will discover a lot on your own, and you will discover even more by talking with someone about a work of art.

The second step in acquiring knowledge about art is much broader. The more conversations you have with experts, curators, art dealers and other collectors the better. Don’t be afraid to ask about whatever comes to mind. Investing in art is not for the timid, not for the shy and not for the overly self-conscious. Everyone has to begin somewhere. As a novice, you will necessarily ask simple questions at first. Sophistication can come later. Always keep an open mind. You never know what you will discover.

When you are not acquiring knowledge through discussion with those more knowledgeable than yourself, you should read as much as possible. You could start with the fascinating autobiographies of collectors, such as Thomas Hoving’s books on colleting for the Metropolitan Museum of Art and Peggy Guggenheim’s Out of This Century, Confessions of an Art Addict. You can find any number of entertaining books on collectors and collecting. For reading more along the line of what you should know specifically as an art investor, you could dip into Ian Robertson’s book The Art Business or Ron Davis’ Art Dealer’s Field Guide: How to Profit in Art, Buying and Selling Valuable Painting. This kind of general reading will give you a good idea of the ins and outs of your chosen field of investment.

Successful investing in art is predicated on making acquisitions appropriate to your purpose. Because you want the dividends of pleasure in looking at your collection, you should try to acquire as much knowledge as you can about the works you acquire. Read as much as possible about contemporary art and contemporary artists and peruse as many magazines as possible – like this one – to familiarize yourself with work in

various media.

There is no substitute for attentive study of what is available on the art market. Talking, reading and – first and foremost – looking will ensure that you make your decisions on acquisitions for investment from an advantageous position. After all, one of the goals of investing is to reduce risk. This can only be achieved by making an effort to understand what you are investing in and the systems of commerce in art. The more you know, the less the risk.

By Dr. Alan McNairn

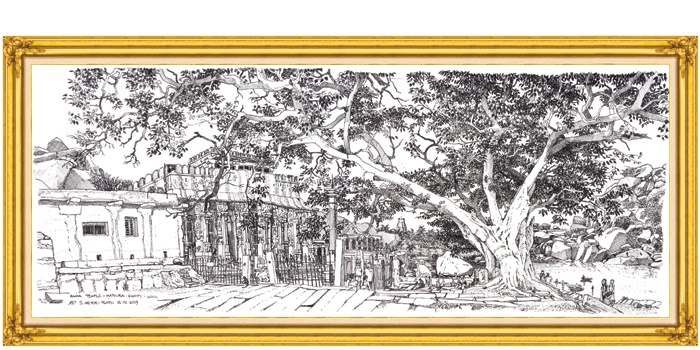

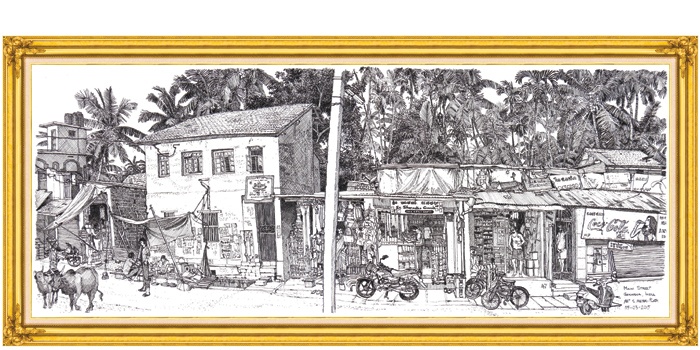

Pictured above (frames excluded):

Gokarna Main Street India | Rama Temple India by Stuart Meyer-Plath

www.stuartmeyer-plath.wix.com/stuart-meyer-plath

Recent Comments